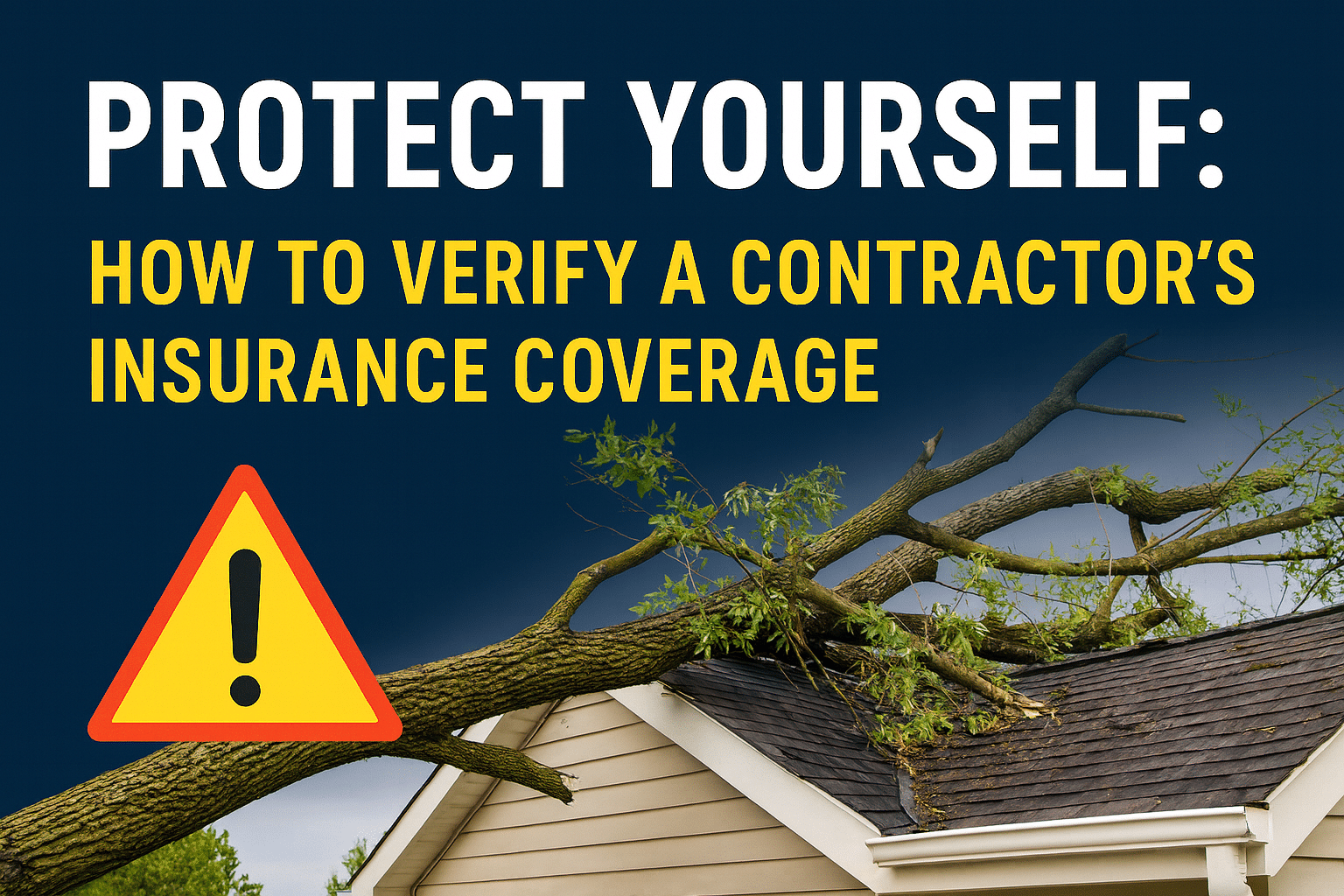

Recently in Pennsylvania, a homeowner hired a tree service contractor who swore he was “fully insured.” They figured the worst that could happen was a dented fence or a broken flower bed. Instead, mid-job, a worker took a chainsaw injury that sent him straight to the ER. The homeowner thought, “Well, that’s what insurance is for.” Except it wasn’t. The contractor only carried general liability—not workers’ comp. Guess who got stuck with the six-figure medical bills? Not the contractor. The homeowner.

General Liability vs. Worker’s Comp: What’s the Difference?

Let’s cut through the jargon:

- General Liability Insurance → covers what they break: your siding, your fence, your car.

- Workers’ Compensation Insurance → covers what they break: themselves. Medical bills, rehab, lost wages.

Here’s the problem: a lot of contractors say “fully insured” when they only mean general liability. The reason? Worker’s comp is significantly more expensive. Why? Replacing a broken roof might cost $10,000. Covering a broken body can run into the hundreds of thousands.

That leaves you wide open. If someone gets hurt on your property and there’s no workers’ comp, you’re the one with the bullseye on your back.

Why Tree Work is Different

This issue can pop up in any trade, but tree work is in a league of its own. Remodeling contractors, for example, may be solo operators or use subs, and the rules about workers’ comp can look a little different.

Tree work, though? It’s hands down one of the most dangerous jobs in the country. Crews climb 60–80 feet in the air with chainsaws, swing heavy limbs over houses, and rig down trunks that weigh thousands of pounds. The risk is built in, every single day.

Why Verification Matters

That’s why you should always verify. Ask for their declarations page. If the workers’ comp section is blank, that’s your cue to hand them a rake and say, “thanks, but no thanks.”

How to Verify Insurance Online

Both Pennsylvania and New York make it easy to double-check:

- Pennsylvania: PA Workers’ Compensation Insurance Search Tool

- New York: NYS Workers’ Compensation Coverage Search

Type in the contractor’s name and you’ll see if their policy is active. No listing? Big red flag.

The Bottom Line

Tree work is no joke. Climbers dangle with chainsaws 60 feet up, massive limbs swing overhead, and whole trunks are dropped to the ground. According to industry data, tree-care workers suffer about 239 injuries per 10,000 workers every year—nearly three times the national average across all industries—and more than 60 fatalities annually in the U.S.

Now, at first glance “239 per 10,000” might not sound like much. But that means nearly 1 in 40 tree workers will suffer a serious injury this year. And unlike many other trades, those injuries tend to be catastrophic—falls, crushing impacts, chainsaw accidents. This is not a low-risk job.

With risks this high, insurance isn’t optional—it’s essential. Before you hire:

- Ask for the dec page and make sure both liability and workers’ comp are listed.

Verify online that the policy is current.

Hiring a contractor with real workers’ comp coverage isn’t just about checking a box—it’s what separates professionals from corner-cutters. It’s proof you’re working with someone who values their crew, respects your home, and takes safety seriously.